Drive loan and deposit growth

Your institution offers essential loan and deposit products to help members achieve their dreams.

Prisma Campaigns gives you options to offer the right products at the right time.

Learn how Prisma has helped banks and credit unions drive loan and deposit growth

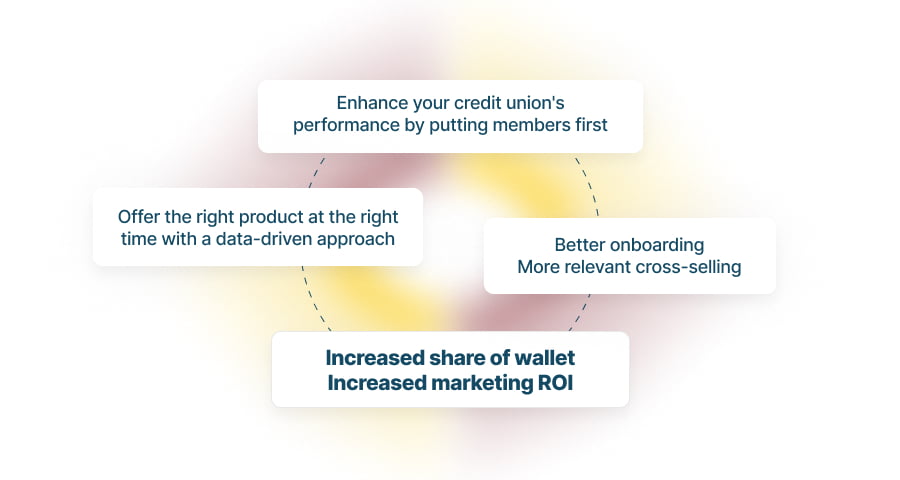

Drive growth while meeting members’ needs

Prisma Campaigns helps credit unions achieve growth and member satisfaction simultaneously. By delivering what members truly need, we optimize deposit and loan growth. Our data-driven approach enables targeted member outreach and personalized experiences that deepen relationships.

Enhance onboarding and cross-selling with the next-best offer

The first 90 days account for 75% of all cross-selling. It’s crucial to make the most of this period by meeting members where they are with tailored offers and messages that match their needs. Use insights gained from data analysis to drive growth and satisfaction with timely product recommendations.

Increase share of wallet and marketing ROI

By adopting a data-driven approach, you can enhance the activation and engagement of indirect and single-product members, which can lead to an increase in share of wallet and marketing ROI. Tailor marketing efforts to specific segments, maximize cross-selling, and improve customer experience for boosted revenue and profitability.

Increase share of wallet while meeting members' needs

See how becoming data-driven can change the way you onboard and cross-sell to your members.

- Oregon

- $650M in assets

- 35,000 members

6X

more HELOC sales

$3.5M

direct sales

500%

increase in engagement

The challenge

Needed to improve outreach and better serve members. Email lacked targeting and personalization.

The solution

Marketing Automation was implemented with 25-30 personalized, longer-term campaigns focused on the member journey.

Fill in to download a copy of the case study

From shooting in the dark to targeted offerings

See how targeting can improve your marketing ROI

Unleash the power of your data

Insights and ideas from credit union experts to help you tap your data for marketing results.

The Digital Marketing playbook for financial institutions

An essential guide for banks and credit unions to unlocking ROI, even with limited resources.

Have another challenge?

- Grow membershipMembers acquisition and retention to better serve communities

- Drive loan and deposit growthOnboarding and cross-selling to increase share of wallet

- Improve members’ financial well-beingPersonalized messages with the right offer at the right time

- Elevate digital experiencesEngage younger generations with fully digital campaigns in multiple channels

- Do more with existing resourcesImprove employee experience and efficiency through automation and integrations

Request a live demo

We’ll show you how you can use Marketing Automation to deepen relationships, boost loyalty and increase share of wallet.